Personal Finance

Budgeting for Holidays: Avoiding Overspending

Introduction:

The holidays are a time for joy, celebration, and spending time with loved ones. However, they can also be a time of financial stress if you're not careful with your spending. It's easy to get caught up in the excitement of the season and overspend on gifts, decorations, and …

Budget Categories: Organizing Your Finances

Introduction

Managing money effectively is crucial for financial well-being, and it all starts with a well-structured budget. A budget acts as a roadmap for your finances, guiding your income towards expenses, savings, and investments. At the heart of every successful budget lies a clear understanding of budget categories. These categories …

Entertainment Budgeting: Having Fun Without Overspending

Introduction:

Entertainment is a vital part of life, offering a much-needed respite from our daily routines and a chance to unwind, connect with loved ones, and create lasting memories. However, the cost of entertainment can quickly add up, putting a strain on our finances. That's where entertainment budgeting comes in …

Budgeting for Retirement: Securing Your Future

Introduction

Retirement. It's the golden beacon at the end of our career paths, a time to relax, travel, and enjoy the fruits of our labor. But achieving a comfortable and enjoyable retirement requires careful planning and diligent saving, starting long before our anticipated retirement date. This is where budgeting for …

How to Get Your Free Credit Report

Introduction

Your credit report is a detailed record of your borrowing and repayment history. It's compiled by credit bureaus, which are companies that collect and maintain financial data about individuals. Lenders use your credit report to assess your creditworthiness when you apply for loans, credit cards, and even services like …

Factors Affecting Your Credit Score

Introduction:

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Lenders use this score to assess your likelihood of repaying a loan. A higher score indicates good credit management and makes you eligible for lower interest rates and better loan terms. Understanding the …

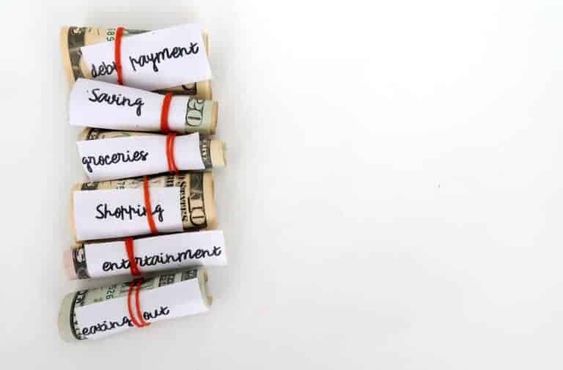

Envelope Budgeting System: How It Works

Introduction

In a world of digital payments and instant gratification, it's easy to lose track of your spending. The envelope budgeting system offers a tangible solution to regain control of your finances. This method, time-tested and proven effective, involves dividing your cash into designated envelopes for different spending categories.

Imagine …

Unsecured Credit Cards: Finding the Best Options

Introduction

For those new to credit or rebuilding their credit history, unsecured credit cards can seem like a risky proposition. Unlike secured cards, which require a security deposit, unsecured cards don't require collateral. This makes them a potentially attractive option, but it also means lenders see you as a higher …

Wealth Management Services: Comprehensive Financial Planning

Introduction

Wealth management services provide comprehensive financial planning and investment management strategies to help individuals and families achieve their financial goals. These services go beyond simple investment advice and encompass a holistic approach to managing your finances. Whether you're saving for retirement, purchasing a home, or securing your children's education …

Trust Services: Estate Planning and Management

Introduction:

Estate planning and management are crucial aspects of financial well-being, providing peace of mind for you and your loved ones. Trust services play a vital role in this process, offering a comprehensive framework to protect and distribute your assets according to your wishes. By establishing a trust, you can …